Credit cards are a convenient way to pay for everyday items, such as groceries, gasoline, clothes, and other goods and services. They’re also a convenient way to shop for items that cost a considerable amount of money, such as electronics and furniture because they can allow you to purchase these items even with a deficit of funds. And best of all, many credit companies offer credit card rewards, such as cash back on purchases and miles points.

If you own and regularly conduct transactions using cryptocurrency, you may want to consider getting a crypto credit card. But what is it, and what benefits can it offer? Read on to learn more.

What Is a Cryptocurrency Credit Card?

Cryptocurrency credit cards allow cardholders to spend crypto for purchases and earn cryptocurrency rewards.

Like most traditional credit cards, transactions are conducted via popular credit card networks, such as Mastercard, Visa, American Express, and Discover. This means that if Mastercard issues your credit card, your card will be accepted everywhere Mastercard credit cards are accepted. As a result, you can use cryptocurrency credit cards for purchases just like traditional credit cards.

How Cryptocurrency Credit Cards Work

Cryptocurrency credit cards work much like traditional credit cards. When you purchase items, you’ll earn rewards. But, with cryptocurrency credit cards, you’ll be able to settle your balance with crypto and earn rewards in cryptocurrency.

However, the procedure used to issue rewards varies from company to company, so ensure you look into the rewards process before choosing a crypto credit card, particularly if you’re interested in cryptocurrency investing.

Also, keep in mind that just like ordinary credit cards, cryptocurrency credit cards have balances that need to be paid off to avoid incurring interest or late fees. Additionally, some cryptocurrency credit cards come with additional fees, such as annual fees or foreign transaction fees, so ensure you check the terms and conditions for the card to avoid incurring unexpected fees down the line.

Outrank your competitors with authoritative high da guest post. Gain an SEO edge, increase your domain’s strength, and drive qualified traffic to your site.

Benefits of Cryptocurrency Credit Cards

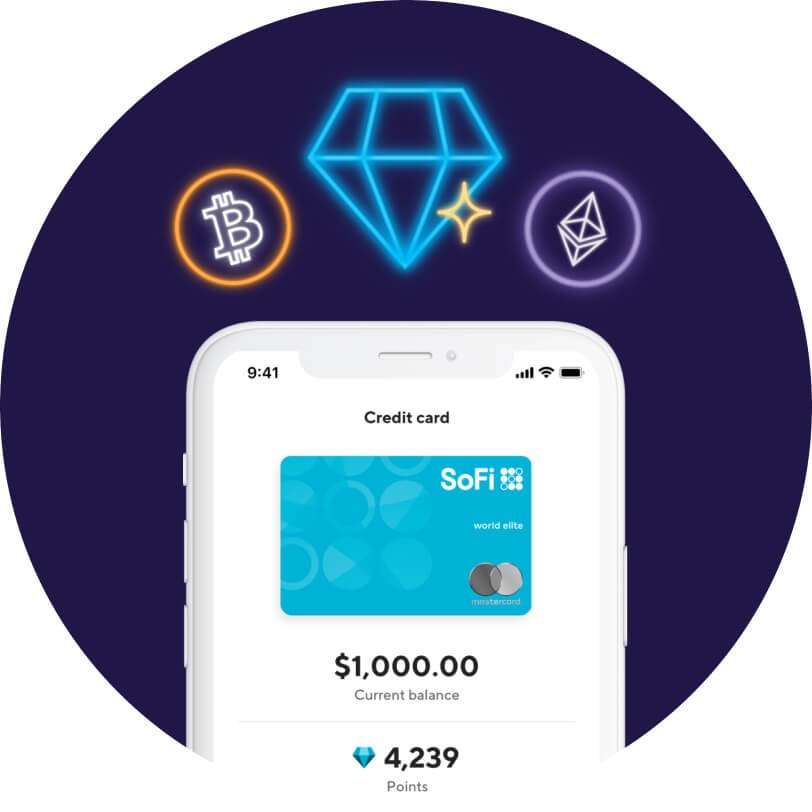

If you regularly transact using crypto, here are some of the benefits you’ll get with a SoFi Invest crypto credit card:

- Zero annual fees: With the SoFi credit card, you won’t be charged annual or foreign transaction fees.

- Cash back rewards: You’ll earn 3% cash back for a year when you set up direct deposit transactions with SoFi. Afterward, you’ll earn 2% unlimited cash back on purchases when redeemed toward saving, investing, or settling an eligible loan with SoFi.

- Reduced interest rate: After 12 consecutive on-time monthly payments of at least the minimum amount due, your APR will be reduced by 1%.

- Rewards from popular brands: Since the SoFi credit card is a World Elite Mastercard card, you’ll receive discounts from partner brands, such as Lyft, ShopRunner, HelloFresh, DoorDash, and more.

According to SoFi Invest, you can “earn 2% unlimited cash back toward your financial goals.” Cryptocurrencies have disrupted the way people transact, and it’s likely they are here to stay. If you regularly transact using crypto, cryptocurrency credit cards can provide you with many of the same benefits regular credit cards provide, and they can facilitate your transactions. On the other hand, if you’re new to crypto and looking to transact using crypto, cryptocurrency credit cards may provide a low-risk way to get started.